Photo by Hans Eiskonen on Unsplash

This will certainly go down as one of the most interesting investment years in recent memory. There’s been a lot of pain felt with inflation pressure and a falling stock market and bond market.

But there have been some silver linings, too. One of those is that bonds, money market funds, CDs, savings accounts and other “fixed income” type financial products are paying considerably more interest than even 6 to 12 months ago.

Here are a few charts to illustrate that “bonds are back,” and how investors can take advantage of the opportunity.

What Higher Inflation Means for Investors

The headline story this year has been the rapid rise of inflation. The chart below illustrates why this is such a unique time.

Source: FRED

As you can see, inflation hasn’t been this high in about 40 years. High inflation can really hurt the economy by causing consumer prices to get out of control. The U.S. Federal Reserve has been given the power to help control inflation by adjusting the level of a key interest rate called the fed funds rate.

Raising this rate increases the cost of borrowing across many areas (like mortgages, business loans, auto loans). This slows the economy and cools inflation. The Fed’s view seems to be that out-of-control inflation (like in the 70s and 80s) is much worse than a slower economy, or even a recession.

How Bonds Are Back

But raising the fed funds rate also helps lenders, earning them more money in interest. That’s where bond investors (like you and me) come in. While raising interest rates does slow economic activity, it doesn’t kill it. There are still borrowers who need money, and one of the biggest borrowers is the United States.

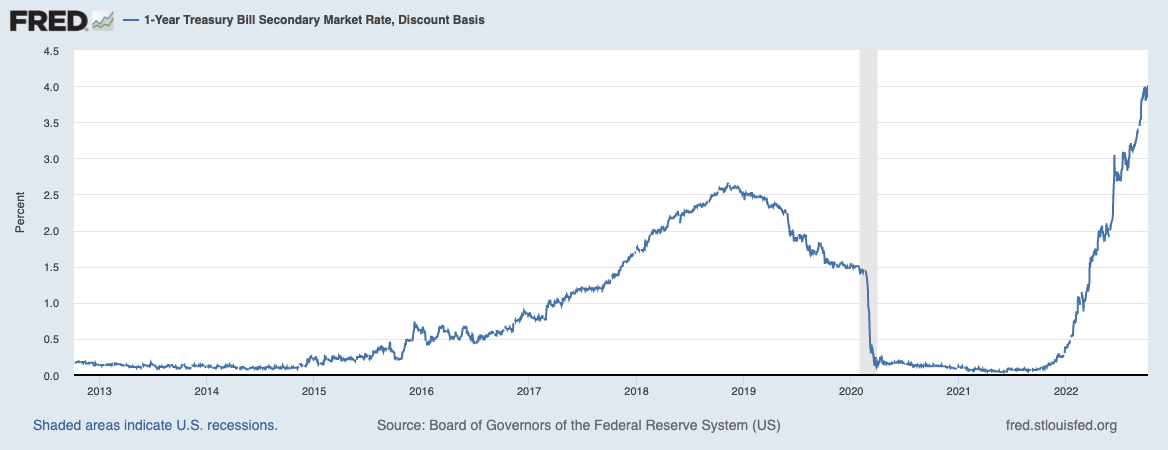

Source: FRED

This chart shows the annual interest rate as of October 6th 2022 for a 12-month US Treasury investment called a treasury bill, or t-bill. In short, you can lend money to the US Treasury by purchasing a 12-month t-bill and earn 4% interest after 12 months along with your principal investment returned. As you can see, we haven’t seen interest rates this high for over 10 years.

T-bills aren’t the only financial product paying higher rates of interest. Remember, when the Fed raises the fed funds rate, most other rates follow. This means that CDs, money market funds, and savings accounts are all paying much higher interest rates as well. For example, Ally Bank is currently paying 2.25% on its savings account, and over 3% for a 12-month CD.

Use I Bonds as an Inflation Ally

There’s another type of product I’ve written about several times: I bonds. These bonds, also issued by the US Treasury, have an inflation component that helps your investment keep up with inflation.

Source: KS Wright Associates

As of this writing, these bonds are paying 9.62% and they’re fully backed by the US Treasury. You can only purchase up to $10,000 of I bonds per year per person (plus $10,000 in the name of your trust), but these are an excellent protection against the pressures of inflation. Read my full article here to get all the details.

If “bonds are back,” why have my current bond investments lost value?

While bonds tend to be the safer portion of an investment portfolio, they still carry risks. One of these risks is interest rate risk, or the risk that an increase in interest rates can lower the value of your bond investments.

As interest rates increased this year, current bond holdings suffered. Why? Because many current bonds were issued when rates were really low. As rates moved higher, the value of those bonds decreased, since investors can get a bond today that pays a higher interest rate. I wrote all about how this works in this article here.

This doesn’t mean your bond investments are doomed. Not at all. It means that as your current bond investments mature, they will be cashed in and new bonds will be purchased, paying higher rates of interest.

How are Bonds Purchased?

There are a couple of different ways to purchase bond investments. This easiest way is through a bond mutual fund or exchange traded fund (ETF). Bond funds come in all shapes and sizes, with varying levels of risk. Bond funds help your investment to be diversified and lower your costs to acquire new bonds.

Bond funds may be less appealing to some investors, because you can see them go up and down in value on a daily basis. For those who prefer not to see these fluctuations in value, you can purchase investments like t-bills and I bonds directly from the US Treasury at treasurydirect.gov. The website is a little clunky and there’s a learning curve, but it allows you to create an investment account directly with the US Treasury, link a bank account, and purchase these and other types of investments.

I hope this has been a helpful update on the opportunities of bond investing. The rise in interest rates and inflation is painful in many ways, but it presents opportunities as well.